Claim your Next Investors

Ebook today and discover:

5 Battery Materials Stocks We’ve Invested in for 2023

This ebook comes with a FREE subscription to Next Investors, we are a small team of Investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free. Simply enter your email address in the box below and click ‘Claim Ebook’.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

Electric Vehicles need batteries. We think that the demand for three particular battery metals will grow significantly in 2023…

BUT

Only a few mining stocks are ready to meet this demand.

Download the Next Investors "5 Battery Materials Stocks We’ve Invested in for 2023" ebook and you will:

DISCOVER our best ever Investment which grew 8,225% from our Initial Entry Price. Nestled in the heart of Europe, this company is aiming to become the world’s first Zero Carbon Lithium producer. Five offtake deals with major car companies like Stellantis and Volkswagen + a $250M war chest, can you guess who it is?

EXPLORE how this advanced stage project in the Czech Republic could be at the forefront of an Electric Vehicle (EV) battery revolution. Next-gen batteries need this metal. The company is strategically located in Europe in very close proximity to where over 25 EV plants and 30 battery plants will soon be operating.

LEARN how one junior mining company is expanding its discovery of a rare metal in Norway - the majority of the metal comes from a single African country and processing is dominated by China.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

This ebook comes with a FREE subscription to Next Investors, we are a small team of investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

Three battery materials set for a big 2023...

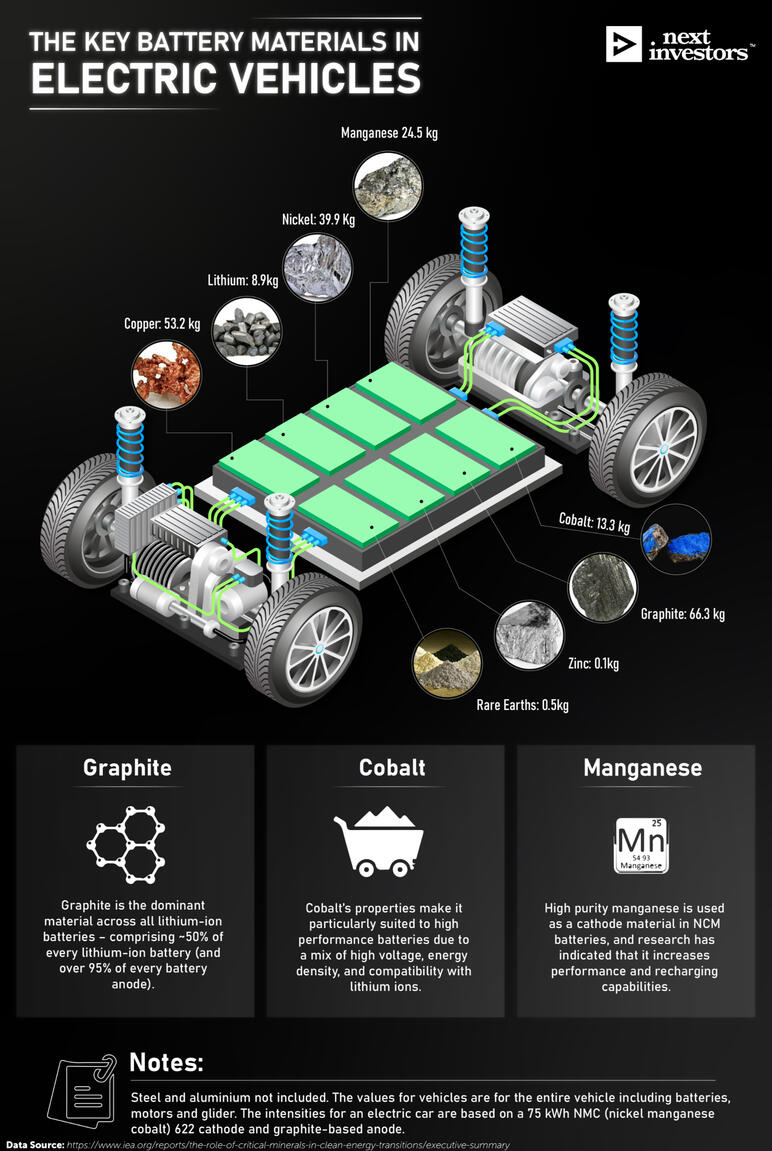

The world is desperate to cut carbon emissions and speed up electrification.Governments, businesses and society need to transition quickly to meet the ambitious net zero emissions targets.The transition won’t be possible without an immense amount of lithium-ion batteries and the raw materials that go in them.As a result of the sheer scale of the demand, and the number of projects that need to come online in the next decade, we are convinced that battery materials are the lifeblood of the energy transition.We’ve been Investing in small cap stocks for 20+ years, and to date, our best Investments have been in the stocks leveraged to the energy transition.We want to repeat that success with the 5 stocks we’ve profiled in this ebook.No doubt, you’ve heard of lithium’s success.But lithium isn’t the only battery material the world needs.Lithium led the charge for many investors, including us, over the past two years. Going forward, we see a lithium-like opportunity in some of the lesser known battery materials.In this ebook, you’ll get an in-depth look at three of the battery materials that are yet to catch the riptide of mainstream conversation and the five companies that we think will ride on this second wave of battery materials demand.The three battery materials we’re talking about are graphite, cobalt and manganese.Below you can see how much of these materials go into an EV battery pack on a kg/EV basis:

Here’s the quick rundown on graphite, cobalt and manganese.

Graphite

Graphite is a form of crystalline carbon found in nature (it can also be made synthetically).It is also a mineral with some unique properties. It is very soft, falls apart easily but it is also extremely resistant to heat and barely reacts with other materials.With high electrical and thermal conductivity - this makes it a great battery material.Graphite is the dominant material across a range of battery chemistries - the average EV has some 70kgs of graphite in it.And supply is lacking - Benchmark Minerals predicts a need of 97 new graphite mines over the next 13 years, assuming 56,000 tonnes/year average mine capacity.In this e-book we profile the two graphite stocks we’ve Invested in.

Cobalt

Cobalt is a moderately reactive hard shiny bluish-grey metal that is usually produced as a by-product of copper and nickel mining.Cobalt’s role in a battery is as a sort of moderating force - it ensures cathodes (not anodes, those are graphite) don’t overheat or even worse catch fire. It also helps extend the life of batteries - automakers usually guarantee their batteries for 8 to 10 years.Because cobalt is so good at improving the longevity of batteries - it's hard to strip out of the supply chain, despite its significant cost.The majority (~70%) of it is sourced from the Democratic Republic of Congo (DRC), which produced 120,000 tonnes in 2021.Meanwhile, China controls 65% of the processing of cobalt.European EV makers are cleaning up their supply chain and we think ethically sourced cobalt from friendly jurisdictions must urgently be discovered and brought online.In this ebook we profile the European cobalt stock we’ve Invested in.

Manganese

Manganese is a hard, brittle, silvery metal and has an array of industrial alloy uses.When we talk about manganese we’re more interested in the high-purity manganese that goes into EV batteries.Manganese rich batteries promise to be a major part of the next generation of battery technology.To meet this demand from next-gen batteries, the world needs to 10x its high purity manganese supply to meet demand by 2030.In this e-book we profile the two manganese stocks we’ve Invested in.

This ebook comes with a FREE subscription to Next Investors, we are a small team of investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

About Next Investors

We have been Investing in the small cap market for 20+ years. We have made money, lost money, and learned many hard lessons along the way. We are still learning.We use our experience to select and Invest in small cap stocks that we believe have a high chance of success and share our views with our readers.Our MissionTo build a high performing ASX micro cap Investment portfolio and share our research, analysis and Investment strategy with our readers.Our Business ModelOur primary business model is to generate long term returns from our Investment Portfolio.We share our views via our newsletter which is free to subscribe to.In order to keep our newsletter free, we offer an exclusive service to the companies we are Invested in, where we will share our research, analysis and Investment journey in the company with our subscribers.We may charge the companies a fee for this service, which is used to cover our operating costs including of our analysts and writers.This is an exclusive service that we only offer to companies that we are Invested in and have been vetted during our rigorous due diligence process.What do I get as a subscriber?As a subscriber you will be the FIRST to know when we announce a new Investment, and you will get regular, ongoing commentary about the companies in our portfolio, how they are progressing against our Investment Memo and new learnings on the effectiveness of our general Investment strategy.Our Investment Memos help us to track a company's progress against a “Big Bet”, which is our high-level Investment thesis for the company over time.Each week we publish around 3 to 5 articles, one weekend edition, and about 15 Quick Takes which are all publicly available on our website.Our newsletter is free to subscribe.